5 Tips for Shopping on a Budget

The first time people get on a budget, they usually find that they’ve been overspending by a significant amount. But even if you have the smallest budget, it’s still possible to buy all of the things you need. Here are some tips, tricks, and strategies:

- Develop a Detailed Budget

The majority of Americans have no formal budget. They just spend whatever they please and hope that they have enough money at the end of the month. But this is no way to live. A budget is one of the foundational elements of personal finance and you need to get serious about it.

“Budgeting is simply balancing your expenses with your income. If they don’t balance and you spend more than you make, you will have a problem,” MyMoneyCoach explains. “Many people don’t realize that they spend more than they earn and slowly sink deeper into debt every year.”

The first step to creating a budget is to calculate how much money you’re earning on a monthly basis. The next step is to calculate fixed expenses that you can’t live without – food, shelter, transportation, childcare, etc. Then you can allocate any leftover money to optional expenses.

- Know the Difference Between Needs and Wants

When creating a budget and shopping, you have to know the difference between needs and wants.

- In reality, there are only four things you need to survive: (1) food and water, (2) a roof over your head, (3) basic healthcare and hygiene products, and (4) basic clothing to keep you protected from the elements.

- Anything that goes beyond your four basic needs of survival is a want. A bigger house, name brand clothing, alcohol, and entertainment – these are all things you want. And while there’s nothing wrong with them, they should be viewed as optional.

When you shop, needs take priority over wants. The only time you purchase a want is when you have extra money in your budget.

- Practice Self-Discipline

Being able to focus on needs and suppress the majority of your wants requires great self-discipline. If you aren’t someone who can walk into a store and keep yourself from purchasing items you want (but don’t need), you’ll have to create systems that remove you from these temptations.

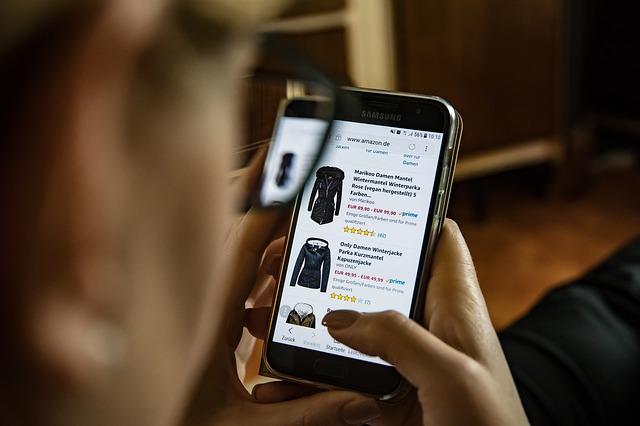

Take grocery shopping as an example. You can lessen your chances of wasting money on items you don’t need by doing your shopping online and scheduling a pick-up or delivery order.

If going into Walmart is your problem, you can also order online and pick up in the store. And by only taking your ID in with you, you can prevent yourself from buying items you didn’t come for.

- Use Coupons and Discounts

When you’re on a strict budget, you have no choice but to be smart with how you spend your money. Coupons and discounts are invaluable.

In addition to shopping around for coupons from a website like MyCoupons, there’s also value in purchasing discounted gift cards from a site like GiftCardGranny. The latter site offers guaranteed percentage discounts from a number of companies – such as Barnes & Noble, JOANN, AMC Theatres, Chili’s, and Kmart.

- Work on Increasing Your Income

“It’s hard to persist when you’re struggling financially. But, what other option do you have? At the end of the day, this comes down to what you focus your thoughts on,” entrepreneur R.L. Adams explains. “Yes, I’m a firm believer in the Law of Attraction and the sheer abundant nature of positive thinking. But, that isn’t enough to help you increase your income this month or next, or any month for that matter.

If you find the idea of sticking to a tight budget too restricting, then your best option is to focus on increasing your income. Whether it’s a second job or a side gig (such as driving for Uber), a few hundred dollars of extra income each month can totally change your outlook and lifestyle for the better.

Don’t Let a Budget Get You Down

A budget might not be exciting, but it doesn’t have to get you down. By being smart with how you shop, you can meet all of your needs and some of your wants.